It’s common for first-time buyers to go for an HDB flat as it offers better security and a more convenient location. Young couples, however, have found it hard to accept. HDB resale flats are a popular alternative for families and young people, and will also help you make savings. Unlike those BTO flat buyers, you don’t want to have to wait years to move into your new home. Or maybe you got priced out of the BTO market by your salary—well done.

In This Article

ToggleIt is difficult to understand the procedure of buying an HDB resale, including the downpayment, the HDB resale grants, and more. Before buying an HDB resale flat in Singapore, here are several things you should know:

Are you eligible to buy an HDB resale flat?

If you need to be married before you get your keys, you can relax. You can get a Marriage Certificate within three months of getting your keys. Here are also other things you should note whether you’re getting a 4-room resale flat or 3-room resale flat:

- Both of you have to be above 21 years old (if you’re over 18 but under 21, you need the consent of your parents to get married!)

- Both of you have to be either Singaporean Citizens or PRs

- You must dispose of your HDB flats and private property within 6 months of purchase.

- You are a single citizen over the age of 35, or two to four single citizens over the age of 35 buying a flat together.

Pick your resale flat Singapore

Search property ads to find the flat of your dreams. While there are many important things to keep in mind when buying a home, don’t forget to do price research. Budgeting for a flat will give you a good idea of how much money you need to save and how you can finance it. Check out flat listings in your area and get a good sense of what’s available.

If you are interested in buying a resale flat, you can buy one from anywhere in Singapore. In new, or newly built areas, you can often find cheaper BTOs. If you are willing to move to a more expensive neighbourhood, you can find cheaper resale flats.

If you are planning to take an HDB loan, you’ll need to get an HDB loan eligibility letter. Your loan eligibility is based on the total loan amount that you want to borrow. Send a valid HLE letter when you exercise your option to purchase.

Survey the flat

You can look at properties on property sites. By housing type and living option Rent an apartment first if you want to buy a condo or apartment for the next 50 years. When it was last renovated, remember the year it was built.

When you’re viewing the flat in person, don’t forget to do these tasks:

- A quick inspection.

- You should check amenities nearby.

- At different times of the day, take note of noise and traffic.

- You should search about the lease period and the upgrade history.

You can try to negotiate the price of the flat. You should befriend the seller’s agent and learn how to price your flat based on real estate transactions. An agent is a good way to sell an investment property. You will usually give them 1% of the property value.

Secure your option

You need an option to purchase when you decide on a flat. You will have to pay an option fee in order to get the OTP. It is up to you and the seller to decide on the fee. Once you paid the option fee, the seller is not allowed to give someone else an OTP until yours is up.

Should you get a loan?

You must act now if you want to get an HDB loan. You need to make your move fast. You’ll need to make a down payment of $20,000 and have good credit to buy a home worth $2 million. HDB loan interest rates are high compared to bank loan rates so don’t assume an HDB loan is a better choice A Letter of Offer from the bank is required for those taking bank loans.

Pay the deposit

You’ve submitted your HLE or Letter of Offer. Now, you can start exercising your OTP by submitting it for approval. A seller will deposit the first payment when they’ve sold their product. Your bank might even let you pay an extra $5,000 for a higher interest rate on your loan if it’s available.

Submit the resale application

As soon as the sale is confirmed, you and the seller should decide on the date to book your first appointment, which you both will attend together. When submitting the Seller Reservation Form, indicate the appointment date you want to book. If either of you is using an agent, the agent should submit the forms on your behalf.

Attend your appointment

The second party has to make an appointment at HDB to submit their portion of the application. Before the appointment can happen, both parties need to agree on a date. To see available dates and times, use the inquiry on available dates.

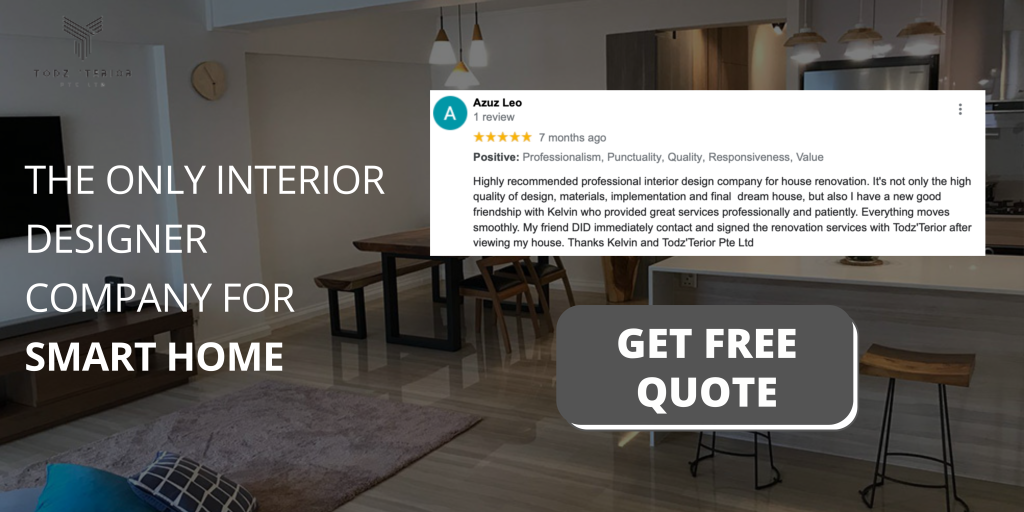

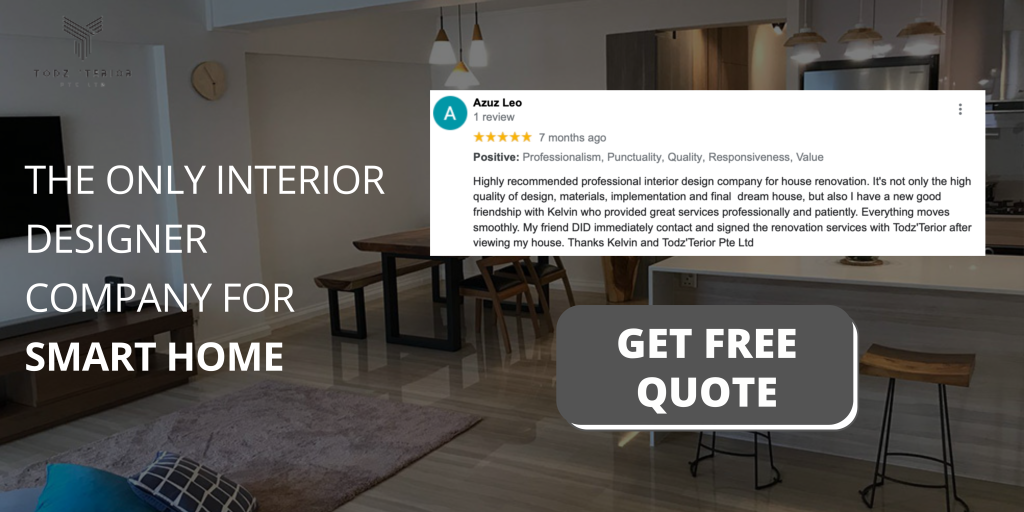

Why You Should Choose Todzterior to remodel your HDB flats?

- You’ll obtain an excellent-experienced designer on a budget.

- Get various 4-resale flat renovation packages that meet your budget with our professional services.

- You’ll get a consultation and if you want to renovate your flat, you’ll go through a few surveys to help you make smart design decisions with an easy process. After five business days, you’ll get two different design concepts for your space, that you’ll then rate and provide feedback on for your designer.

Other interior designs to compare, such as…

Weiken

- If you want good customer service for mid to high-price packages.

- A good home design

- You’ll get a simple and quick process. Pick the area you want to change and choose the design style. Then you’ll receive an estimated quote and you can choose if you want to proceed or not.

LivSpace

- Get experienced designers at a higher cost.

- Stunning design with higher renovation packages.